The rise of Environmental, Social, and Governance (ESG) investing and corporate practices signals a significant shift in how businesses and investors perceive their roles in society and the environment. What started as a niche concept has quickly become mainstream, reshaping corporate operations, capital allocation, and performance assessment. This evolution reflects a growing acknowledgment of the interconnectedness between business activities, societal well-being, and environmental sustainability, prompting a renewed focus on long-term value creation alongside financial returns.

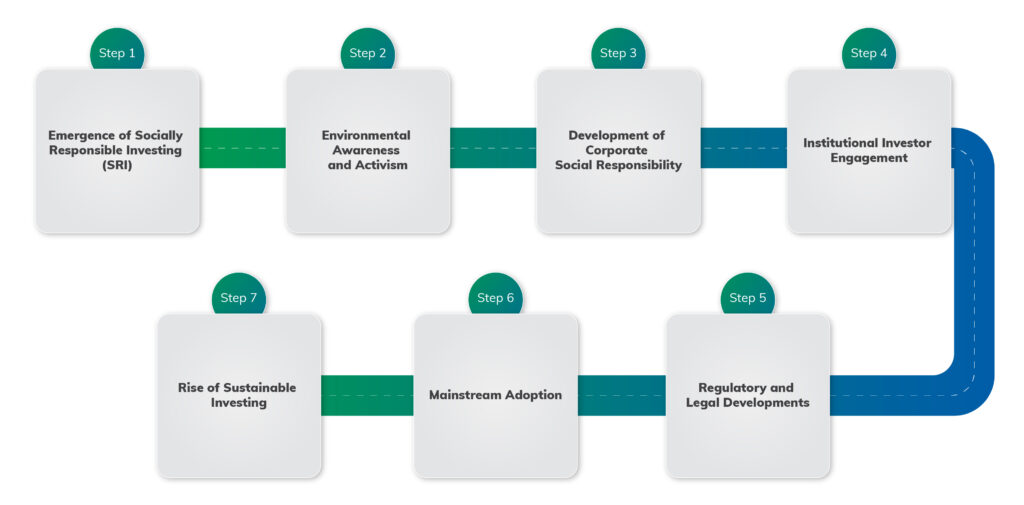

Step wise evolution of ESG -

- Emergence of Socially Responsible Investing (SRI):

Roots of ESG traced to SRI in the 1960s-70s: ESG principles find their origins in the practices of socially responsible investing, which aimed to allocate capital towards companies with positive social impacts while avoiding those involved in controversial industries during the 1960s and 1970s.

- Environmental Awareness and Activism:

Late 20th century saw momentum in environmental movement: The latter part of the 20th century witnessed a surge in environmental activism and awareness, driven by concerns such as pollution, habitat destruction, and climate change.

Increased awareness of pollution, habitat destruction, and climate change: Growing consciousness about environmental issues prompted investors to consider companies' environmental practices as part of their investment decisions, reflecting a broader societal concern.

- Corporate Social Responsibility (CSR):

Late 20th century sees rise of CSR concept: During this period, the notion of corporate social responsibility emerged, emphasizing the ethical operation of businesses, their contribution to society, and efforts to minimize environmental impact.

- Institutional Investor Engagement:

- 1980s-90s: Pension funds, asset managers engage on social, environmental issues: Institutional investors began actively engaging with companies on social and environmental matters during the 1980s and 1990s, recognizing the importance of these factors in long-term performance.

2. Shareholder advocacy drives ESG practice improvements: Shareholder advocacy and engagement campaigns played a significant role in pushing companies to improve their ESG practices during this period.

- Development of ESG Frameworks:

Early 2000s witness emergence of ESG reporting and integration standards: Various frameworks and standards for reporting and integrating ESG factors into decision-making processes began to emerge, including the Global Reporting Initiative (GRI), Principles for Responsible Investment (PRI), and Carbon Disclosure Project (CDP).

- Regulatory and Legal Developments:

- Governments implement ESG-related regulations, disclosure requirements: Governments and regulatory bodies worldwide started implementing regulations and disclosure requirements related to ESG issues, reflecting the increasing importance of these factors in financial markets.

2. UN's PRI (2006) urges ESG integration in investments: The launch of the United Nations' Principles for Responsible Investment (PRI) in 2006 encouraged investors to integrate ESG factors into their investment decisions, further mainstreaming these considerations.

- Mainstream Adoption:

Past decade sees ESG move from margins to mainstream: Over the past decade, ESG considerations have transitioned from being on the fringes to becoming mainstream, with investors, companies, and stakeholders increasingly recognizing their material impact on financial performance and risk management.

- Rise of Sustainable Investing:

Sustainable investing gains popularity: Sustainable investing, encompassing strategies such as ESG integration, impact investing, and socially responsible investing (SRI), has become increasingly popular as investors seek to align their financial goals with broader societal and environmental objectives.

Overall Evolution

- Growing recognition of ESG's role in driving long-term value creation, sustainable development: The evolution of ESG reflects a growing recognition of the importance of environmental, social, and governance factors in driving sustainable development and long-term value creation.

2. ESG integral to investment decision-making, corporate strategy in global landscape: From niche concepts to mainstream imperatives, ESG considerations have become integral to investment decision-making and corporate strategy in today's global business environment