Over recent decades, the landscape of corporate sustainability reporting has undergone a notable evolution, particularly marked by the emergence and maturation of the Business Responsibility and Sustainability Reporting (BRSR) framework. This journey from its inception to mainstream adoption signifies a transformative shift in how businesses perceive and prioritize their environmental, social, and governance (ESG) responsibilities. In India, this evolution has been delineated through a series of regulatory interventions and voluntary initiatives aimed at fostering greater transparency, accountability, and alignment with global sustainability standards. This article delineates a simplified timeline outlining the key milestones in the evolution of BRSR in India, highlighting the legislative mandates, regulatory enhancements, and industry initiatives that have propelled its trajectory towards comprehensive and standardized sustainability reporting practices.

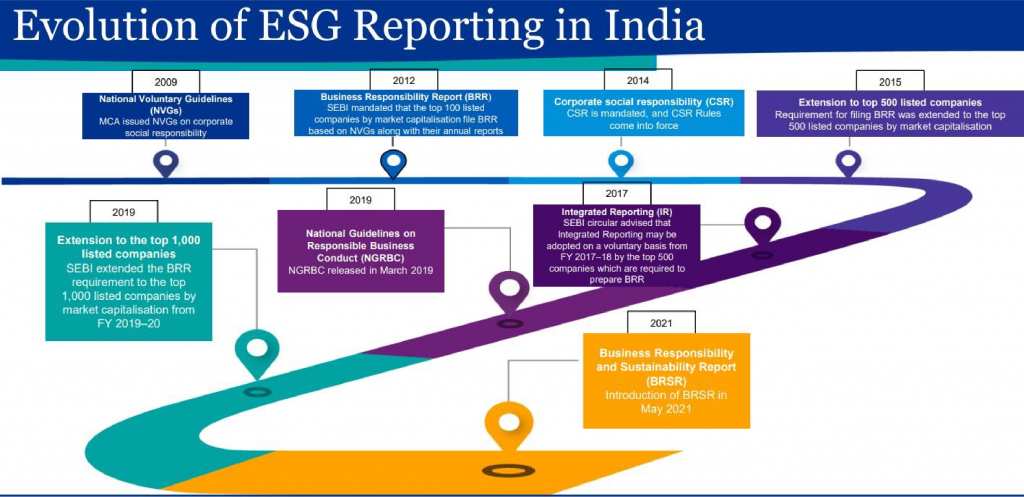

The timeline provided outlines the evolution of Business Responsibility and Sustainability Reporting (BRSR) in India, showcasing a gradual progression from voluntary guidelines to mandatory reporting standards, aligned with international best practices. Let’s delve deeper into each milestone:

2009 – Introduction of NVGs: The Ministry of Corporate Affairs (MCA) introduced the National Voluntary Guidelines on Social, Environmental, and Economic Responsibilities of Business (NVGs). These guidelines served as a voluntary framework for businesses to adopt responsible practices, laying the foundation for BRSR in India.

2011 – SEBI mandates BRRs: The Securities and Exchange Board of India (SEBI) mandated the top 100 listed companies on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) to submit Business Responsibility Reports (BRRs) as part of their annual reports. This marked a significant step towards integrating ESG aspects into corporate reporting.

2014 – Mandate of CSR activities: The Companies Act, 2013 mandated Corporate Social Responsibility (CSR) activities for qualifying companies. This legislative requirement compelled companies to allocate a portion of their profits towards CSR initiatives, emphasizing areas like education, healthcare, and environmental sustainability.

2015 – Expansion of BRSR scope: SEBI expanded the scope of BRSR to the top 500 listed companies, aiming to foster broader corporate reporting on sustainability practices. This expansion reflected growing recognition of the importance of ESG considerations among a wider range of companies.

2017 – Revision of NVGs to NGRBC: The MCA revised the NVGs and released the National Guidelines on Responsible Business Conduct (NGRBC), aligning them with international standards such as the United Nations Guiding Principles on Business and Human Rights. This alignment strengthened the framework for responsible business practices.

2018 – Enhanced disclosure requirements: SEBI enhanced disclosure requirements for BRRs, mandating reporting on activities related to the Sustainable Development Goals (SDGs) as per the NGRBC. This move aimed to align Indian corporate reporting with global sustainability frameworks, enhancing transparency and comparability.

2020 – Mandatory BRR submission: SEBI made the submission of BRRs mandatory for the top 1,000 listed companies, further solidifying the regulatory framework for BRSR in India. This step underscored the increasing importance of sustainability reporting in corporate governance and accountability.

2024 – Continued emphasis on BRSR: BRSR continues to be recognized as an integral aspect of corporate governance and reporting practices in India. Companies increasingly acknowledge the value of sustainability reporting in enhancing transparency, accountability, and trust among stakeholders.

Overall, the evolution of BRSR in India reflects a transition from voluntary initiatives to mandatory reporting standards, driven by a growing awareness of the importance of sustainable business practices and stakeholder expectations.